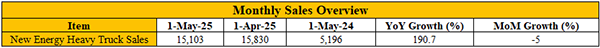

Despite a 5% drop from April’s record 15,830 units, the market remains on an upward trajectory. From January through May, total sales of new energy heavy trucks rose 195% year-on-year to 61,231 units.

Year-on-Year and Month-on-Month Performance in May 2025:

According to terminal registration data, sales of new energy heavy trucks in May 2025 reached 15,103 units, representing a 190.7% increase year-on-year. However, sales declined 5% month-on-month from April’s record of 15,830 units.

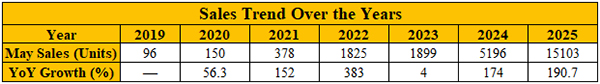

Seven-Year Historical Comparison:

Data show that May 2025 marked the highest May sales volume for new energy heavy trucks over the past seven years. It was also the first time in seven years that May sales exceeded 10,000 units. Given that volumes prior to 2019 were minimal, analysts consider May 2025 a historic high for the segment during this month.

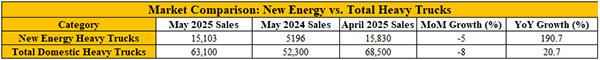

Comparison with the Overall Heavy Truck Market:

While new energy heavy truck sales rose 190.7% year-on-year, the overall heavy truck market in China grew just 20.7% in the same period. Month-on-month, new energy truck sales declined by 5%, compared to an 8% drop across the broader heavy truck segment. Analysts attribute the stronger performance of new energy models to targeted government incentives and increased model availability.

The significant growth in May was attributed to a combination of factors, including a low base in 2024, expanded government subsidy programs aimed at replacing older diesel trucks, and a wider rollout of electric trucks with higher battery capacities. The small decrease in sales from April to May happened because many customers made their purchases earlier than usual—in April instead of May.

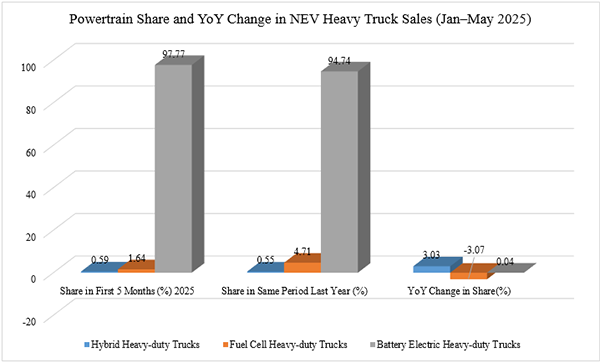

Battery electric trucks continued to dominate the segment, accounting for 97.77% of total sales from January to May. Fuel cell trucks represented 1.64% of the market, down from the previous year, while hybrid trucks made up 0.59%.

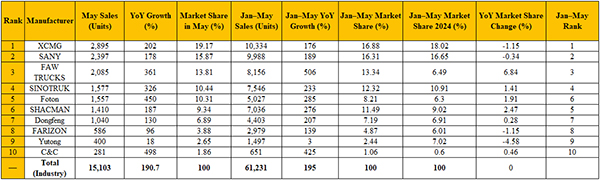

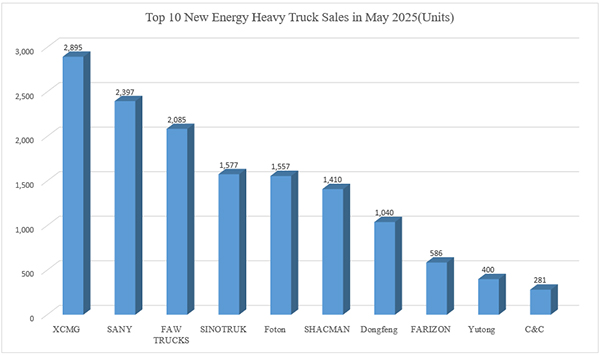

XCMG led the market in May with 2,895 units sold, a 202% increase year-on-year, securing a 19.17% market share. SANY followed with 2,397 units (up 178%), and FAW Jiefang ranked third with 2,085 units, representing a 361% increase. All of the top 10 manufacturers posted year-on-year growth, with C&C recording the highest increase at 498%.

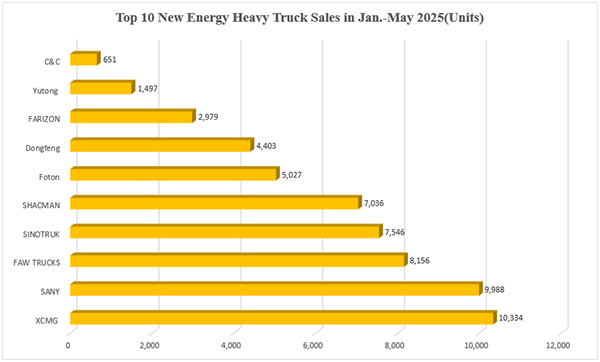

Top 10 New Energy Heavy-Duty Truck Brands by Sales in May 2025 and Jan.–May 2025

For the first five months of the year, XCMG sold 10,334 units, SANY 9,988, and FAW Jiefang 8,156. FAW Jiefang saw the largest gain in market share, up 6.84 percentage points from the same period last year.

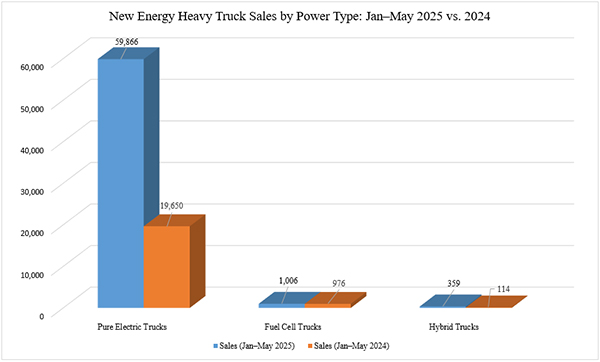

Pure Electric Trucks Dominate China’s New Energy Heavy-Duty Market in Early 2025

Pure electric heavy-duty trucks accounted for the vast majority of new energy truck sales in China during the first five months of 2025, making up 97.77% of the market, according to vehicle registration data.

The share represents a 3.03 percentage point increase from the same period in 2024, underscoring the dominant position of pure electric models—including both plug-in and battery-swapping types—in the sector. Analysts attribute the continued growth to the maturity of electric technology, a broad range of applicable use cases, lower promotional costs, and more convenient charging infrastructure.

Fuel cell trucks held the second-largest share at 1.64%, but this figure marked a decline of 3.07 percentage points year over year—the steepest drop among all categories. Industry observers cite high adoption costs, limited hydrogen refueling stations, and delayed subsidy payouts as key factors behind the slowdown.

Hybrid trucks ranked third with a 0.59% share, reflecting a modest 0.04 percentage point increase from the previous year.

Overall, the data indicates that pure electric heavy-duty trucks are not only maintaining their lead but also driving the growth of China’s new energy commercial vehicle market.

As China continues to promote cleaner transportation and phase out older diesel models, the new energy heavy truck segment is expected to maintain strong momentum throughout 2025.