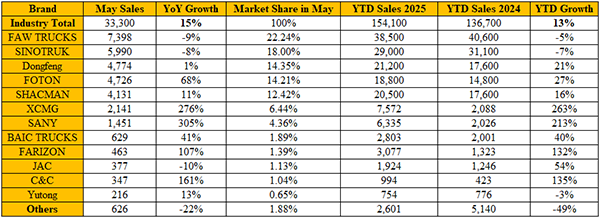

The overall heavy-duty truck market reached 63,100 units in May, with tractor trucks accounting for 52.7% of sales. Although the monthly figure fell short of past highs, it ranked second among May totals over the past five years. Cumulative sales from January to May reached 154,100 units, up 13% year-over-year.

FAW Jiefang Maintains Lead; SANY Reports Triple-Digit Growth

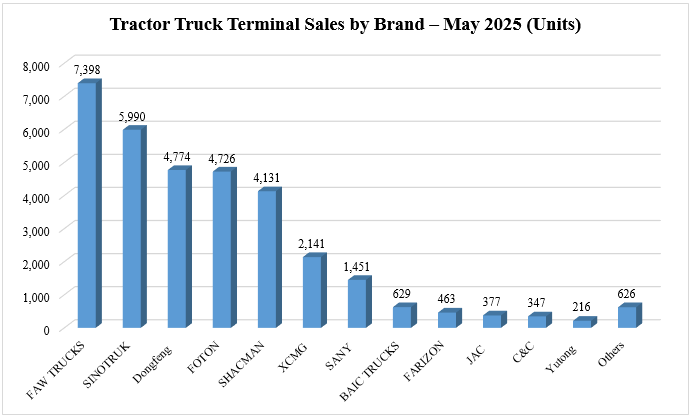

FAW Jiefang retained the top position in May with 7,398 units sold, followed by CNHTC (Sinotruk) at 5,990 units. Dongfeng, Foton, and Shaanxi Auto rounded out the top five, each with over 4,000 units sold.

Of the 12 leading brands, nine recorded year-over-year growth. SANY, XCMG, and Farizon posted the strongest gains with increases of 305%, 276%, and 107%, respectively. Foton, Shaanxi Auto, BAIC, and Yutong also reported double-digit growth, while a few manufacturers experienced sales declines of up to 10%.

Tractor Truck Terminal Sales by Brand – May 2025 (Units)

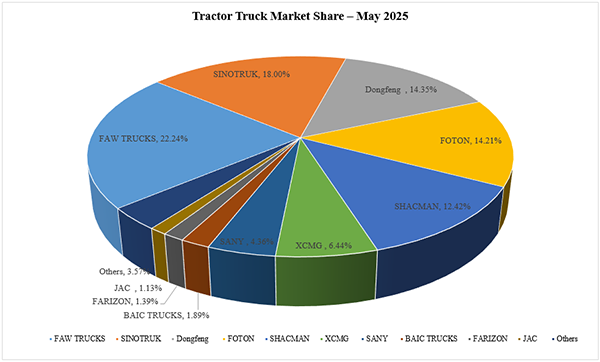

The top 10 companies held 96.4% of the market in May. FAW Jiefang led with a 22.24% share, followed by CNHTC (18.00%), Dongfeng (14.35%), Foton (14.21%), and SHACMAN(12.42%). Collectively, these five accounted for more than 80% of the total market.

China’s tractor truck market reported solid growth in the first five months of 2025, with cumulative sales reaching 154,100 units, a 13% year-on-year increase, according to the latest terminal registration data. The share of new energy tractor trucks rose significantly to 28.87%, nearly doubling from 17.43% a year earlier.

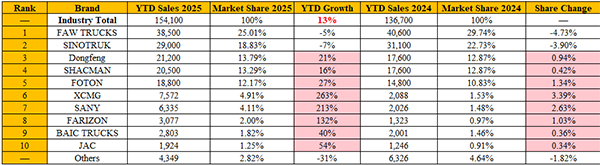

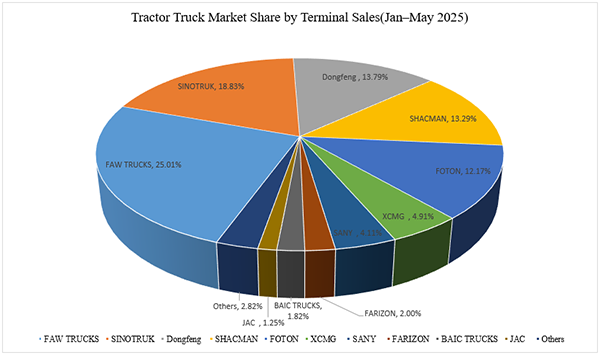

China's Top 10 Tractor Truck Sales Rankings (Jan–May 2025, Units)

Eight of the top 10 manufacturers posted year-on-year sales increases, with XCMG, SANY, and Farizon achieving triple-digit growth of 263%, 213%, and 132%, respectively. Other major players, including Dongfeng, SHACMAN, Foton, and JAC, also outpaced the overall market growth rate. Meanwhile, market concentration remained high. The top 10 companies accounted for 97.18% of total sales, with FAW TRUCKS leading at 25.01% market share, followed by SINOTRUK (18.83%), Dongfeng (13.79%), SHACMAN (13.29%), and Foton (12.17%).

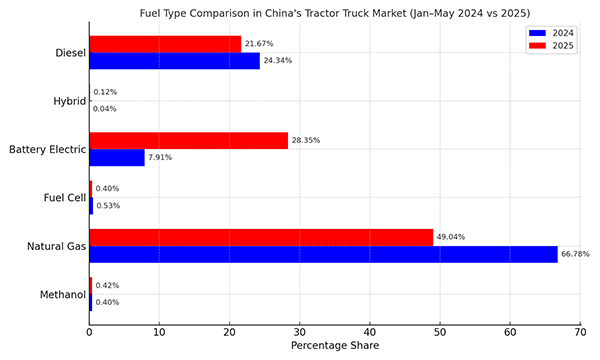

New Energy Tractor Trucks See Significant Gains

The new energy segment, comprising battery-electric, hybrid, and fuel cell tractor trucks, grew substantially in the first five months of 2025. Sales in the category surged 284% year-over-year. Battery-electric trucks increased 304%, hybrids 237%, while fuel cell trucks declined 14%.

Diesel trucks remained the dominant powertrain but grew only marginally. Natural gas trucks saw a 17% drop in sales. As of May, new energy models made up 28.87% of all tractor truck sales, compared to 17.43% for the full year in 2024, and exceeded the 21.44% new energy share in the broader heavy truck market.

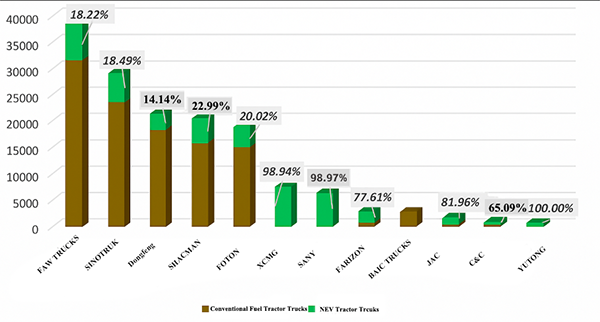

Eleven of the top 12 brands now offer new energy tractor trucks. Companies such as XCMG, SANY, Farizon, and JAC reported new energy models making up over 75% of their tractor truck sales, with some nearing full electrification. SHACMAN and Foton also reported new energy shares above 20%.

Share of New Energy Tractor Trucks in Each Manufacturer’s Total Tractor Sales (Jan–May 2025)

Unit: Vehicles

China’s tractor truck market has shown steady growth in 2025, with new energy models emerging as a key driver. While natural gas vehicles face headwinds, they continue to play a significant role. Analysts expect both new energy and gas-powered trucks to shape the next phase of market development.