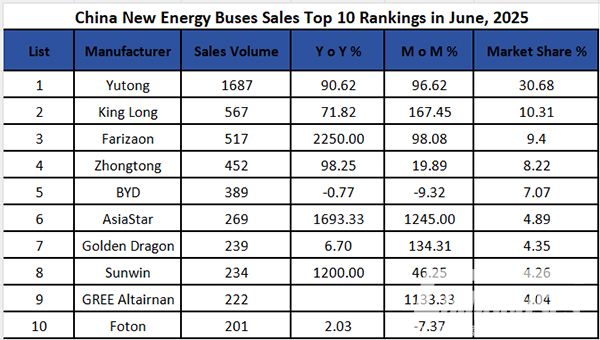

June 2025 Sales:

Yutong remains at the top, while King Long surges to second place.

Farizon sees a significant increase and ranks third.

The strong growth of the new energy bus market is the result of the combined efforts of policies, market demand, and technology. The implementation of the "trade-in" subsidy policy has stimulated the renewal of the public bus market; the peak summer season has led to a concentrated surge in demand for group commuting and tour buses, adding fuel to the new energy bus market; bus manufacturers, through technological innovation and product upgrades, have improved vehicle performance, extended range, and enhanced comfort, winning an increasing market share.

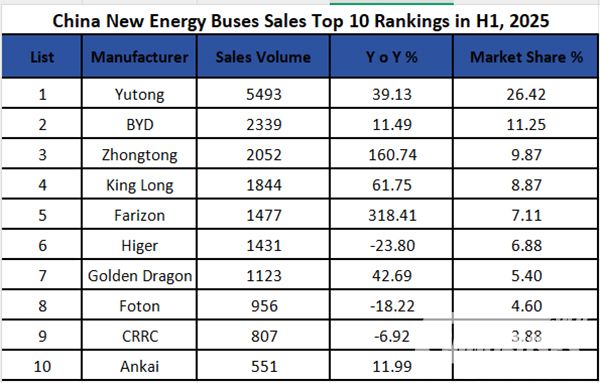

Half-Year 2025 Review:

The top three positions are firmly held by Yutong, BYD, and Zongtong.

Ankai makes a comeback and enters the top ten.

Looking at the sales in the first half of this year, the market structure has become clearer.

From January to June this year, the cumulative sales of new energy buses over 6 meters in length reached 20,788 units, a year-on-year increase of 33.14%, indicating that the new energy bus market is steadily recovering.