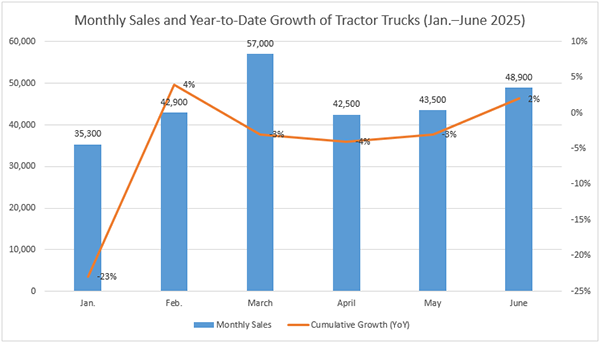

China’s tractor truck market sold more than 270,000 units in the first half of 2025, up 2% from a year earlier, according to data from the China Association of Automobile Manufacturers. While the overall heavy-duty truck market expanded 7% during the same period, tractor truck growth remained more modest, continuing to trail the broader segment.

In June alone, 48,900 tractor trucks were sold, marking a 12% increase from May and a 31% rise year over year. The monthly total was the highest so far in 2025 and the second-highest for the same month over the past five years, trailing only June 2021. However, despite the rebound — especially compared to last month’s marginal 0.2% year-over-year gain — June was the fourth consecutive month in which tractor truck growth lagged behind the overall heavy-duty market, which saw a 10% month-on-month and 37% year-on-year increase. The segment continues to underperform relative to broader market trends.

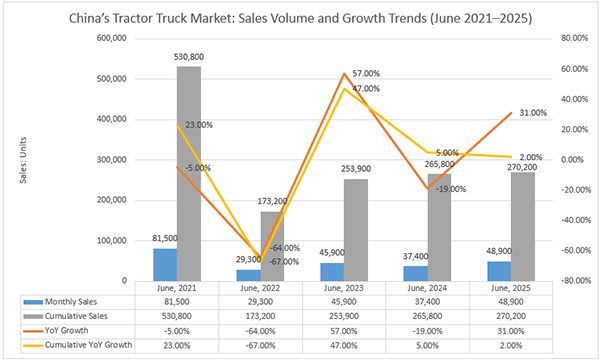

Three out of the past five years saw June sales exceed 40,000 units. The peak was in June 2021, with 81,500 units sold. In contrast, June 2022 experienced a sharp 64% year-on-year drop, falling below 30,000 units. This was followed by a strong rebound of nearly 60% in 2023, and then a 19% decline in 2024, again pushing sales below the 40,000-unit threshold.

In June 2025, the market saw a significant recovery with a 31% year-on-year increase, reaching 48,900 units — the second-highest June sales figure in the past five years. This total was about 33,000 units fewer than the 2021 peak but more than 11,000 units higher than June 2024.

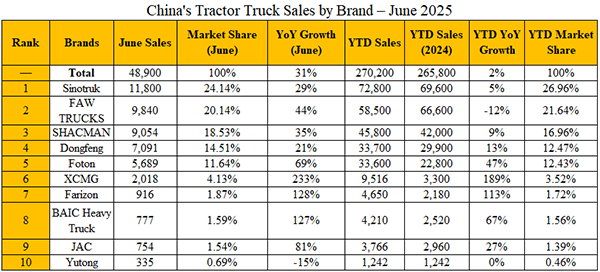

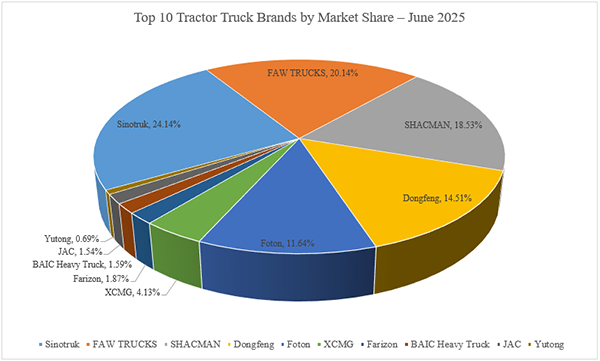

SINOTRUK remained the market leader in June with 11,800 units sold, the only company to surpass the 10,000-unit threshold for the month. FAW TRUCKS, SHACMAN, Dongfeng and Foton rounded out the top five manufacturers, which collectively accounted for nearly 89% of monthly sales.

Among the top 10, nine brands reported year-over-year growth, while one recorded a 15% decline. XCMG and Farizon posted the strongest gains, with sales up 233% and 128%, respectively. Foton saw a 69% increase. One brand reported a 15% decline.

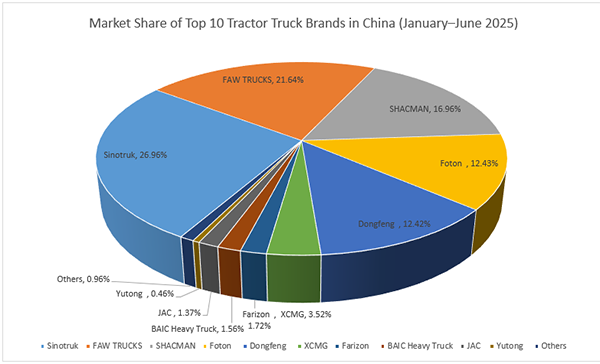

For the first half of the year, SINOTRUK held the largest market share at 26.96%, followed by FAW TRUCKS (21.64%), SHACMAN (16.96%), Foton (12.43%) and Dongfeng (12.42%). The top 10 manufacturers captured 99.04% of the market.

XCMG and Farizon showed the most significant year-to-date growth, up 189% and 113%, respectively. Foton and BAIC Heavy Truck also saw strong gains of 47% and 63%.

China’s tractor truck market posted total sales of 270,200 units in the first half of 2025, up 2% year over year, according to data from the China Association of Automobile Manufacturers. The sector returned to positive cumulative growth after ending May down 3%, selling approximately 4,400 more units than the same period in 2024.

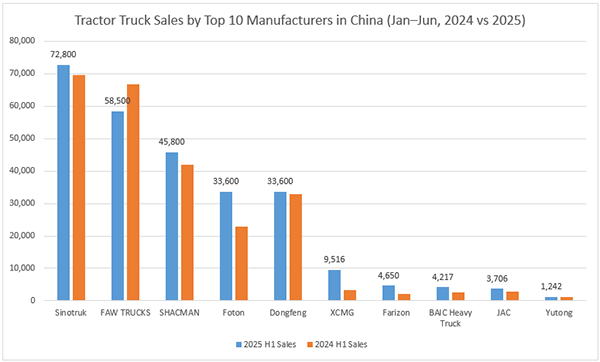

Among the top 10 manufacturers, eight recorded year-on-year growth, while two posted declines. XCMG and Farizon led the gains, with sales more than doubling—up 189% and 113%, respectively. Foton and BAIC Heavy Truck also delivered strong results, with year-to-date growth of 47% and 63%. Other major players, including Sinotruk, SHACMAN, Dongfeng, and JAC, reported increases of 5%, 9%, 2%, and 27%, respectively.

Only two of the top 10 manufacturers experienced a drop in cumulative sales. The most significant decline was a 12% year-on-year decrease.

Together, the top 10 companies accounted for 99.04% of total tractor truck sales in the first half of the year. SINOTRUK maintained its leading position with a 26.96% market share, followed by FAW TRUCKS at 21.64%. SHACMAN and Foton held 16.96% and 12.43%, respectively, while Dongfeng rounded out the top five with 12.42%. Collectively, these top five manufacturers controlled over 90% of the market, highlighting their dominant presence.

The rankings of the top 10 manufacturers shifted from late 2024. Farizon rose from 10th to 7th, Foton from 5th to 4th, XCMG from 7th to 6th, and Yutong entered the top 10 at 10th place after ranking 12th in 2024. Companies with slower growth slipped in the rankings or fell out of the top 10.

With half the year remaining, the market continues to evolve. Although tractor trucks remain behind the broader heavy-duty segment, continued growth in select brands suggests potential for further shifts in market share.